Unlocking Financial Savings: Your Ultimate Overview to Inexpensive Auto Insurance Coverage

Browsing the landscape of vehicle insurance policy can usually really feel overwhelming, yet understanding the important elements can unlock significant savings. Elements such as your driving background, automobile type, and coverage choices play a crucial duty in identifying your premium expenses. By strategically coming close to these aspects and comparing various providers, one can discover substantial price cuts. The process does not end with simply selecting a plan; rather, it demands recurring evaluation and informed decision-making to make sure optimal defense and price. What actions can you require to optimize your cost savings while maintaining the required protection?

Comprehending Automobile Insurance Essentials

Comprehending the fundamentals of vehicle insurance policy is vital for any vehicle owner. Vehicle insurance coverage works as a safety procedure against financial loss arising from mishaps, theft, or damages to your vehicle. It is not only a legal demand in the majority of territories yet additionally a reasonable investment to safeguard your assets and wellness.

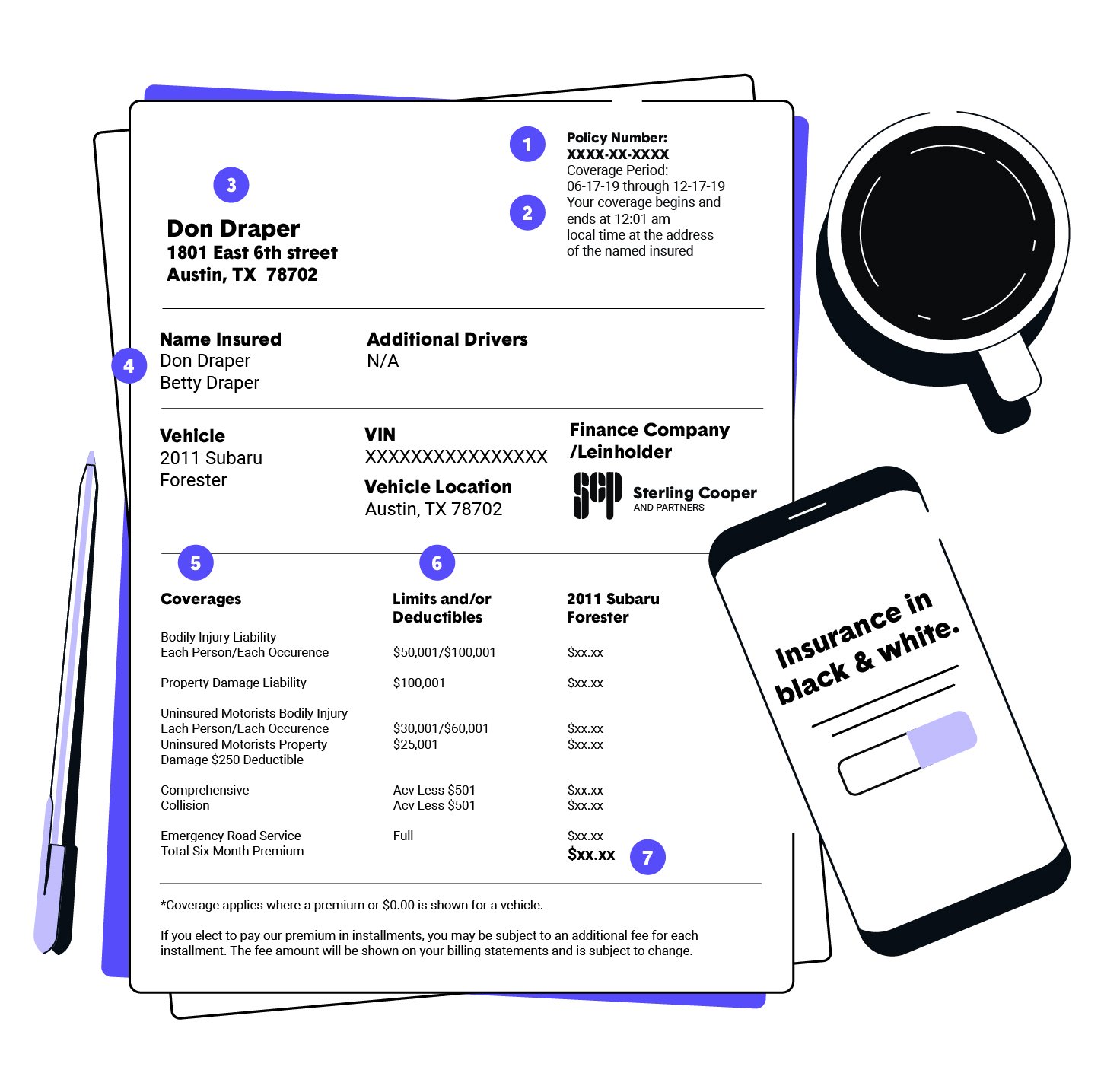

At its core, car insurance typically contains a number of vital elements, consisting of obligation insurance coverage, accident protection, and comprehensive protection. Obligation insurance coverage safeguards you versus cases occurring from problems or injuries you create to others in an accident. Crash protection, on the various other hand, covers problems to your automobile resulting from a crash with another automobile or item, while thorough coverage secures against non-collision-related occurrences, such as burglary or natural catastrophes.

Furthermore, recognizing policy limits and deductibles is important. Policy restrictions figure out the maximum amount your insurance provider will pay in case of a case, while deductibles are the amount you will pay out-of-pocket prior to your insurance policy begins. Familiarizing on your own with these principles can empower you to make enlightened choices, guaranteeing you pick the ideal coverage to fulfill your demands while maintaining price.

Factors Impacting Premium Costs

Numerous variables considerably influence the cost of auto insurance coverage premiums, impacting the general affordability of coverage. Among the key factors is the chauffeur's age and driving experience, as younger, less seasoned chauffeurs typically face greater premiums because of their enhanced risk account. In addition, the kind of automobile insured plays a critical role; high-performance or luxury autos typically incur greater prices as a result of their fixing and substitute expenses.

Geographical place is another important variable, with urban areas usually experiencing higher premiums compared to country areas, mostly due to boosted traffic and mishap rates. The vehicle driver's credit score history and declares history can likewise influence costs; those with a bad credit score or a background of constant cases may be billed higher prices.

Furthermore, the level of insurance coverage chosen, consisting of deductibles and plan restrictions, can affect premium prices substantially. Finally, the function of the lorry, whether for individual use, travelling, or organization, might also determine premium variations. Comprehending these variables can help consumers make educated choices when seeking economical car insurance coverage.

Tips for Lowering Costs

Minimizing automobile insurance costs is achievable through a selection of strategic strategies. One reliable technique is to increase your insurance deductible. By choosing a greater deductible, you can lower your costs, though it's vital to guarantee you can comfortably cover this amount in the occasion of a case.

Utilizing offered discount rates can even more reduce costs. Lots of insurance companies offer price cuts for risk-free driving, packing plans, or having certain safety and security features in your lorry. It's a good idea to inquire concerning these options.

An additional strategy is to examine your debt score, as several insurer factor this right into premium calculations. Improving your debt can result in much better rates.

Lastly, think about enrolling in a chauffeur security course. Finishing such training courses usually certifies you for costs discounts, showcasing your commitment to secure driving. By applying these strategies, you can properly lower your automobile insurance coverage costs while keeping adequate coverage.

Contrasting Insurance Policy Service Providers

When looking for to lower car insurance coverage expenses, contrasting insurance coverage providers is an important action in locating the very best insurance coverage at an economical rate. Each insurance provider uses distinct plans, protection choices, and prices structures, which can dramatically influence your general expenditures.

To begin, gather quotes from multiple service read here providers, guaranteeing you maintain regular coverage degrees for an accurate contrast. Look past the premium expenses; scrutinize the specifics of each policy, consisting of deductibles, responsibility limits, and any kind of additional attributes such as roadside aid or rental car insurance coverage. Comprehending these elements will certainly aid you identify the value of each plan.

In addition, think about the credibility and customer support of each provider. Research online testimonials and ratings to determine customer contentment and claims-handling performance. A supplier with a solid record in solution might be worth a slightly higher premium.

When to Reassess Your Policy

Regularly reassessing websites your auto insurance plan is critical for making sure that you are receiving the ideal coverage for your needs and budget plan - auto insurance. Additionally, getting a brand-new vehicle or marketing one can change your protection requirements.

Adjustments in your driving routines, such as a brand-new job with a much longer commute, need to additionally trigger a reassessment. Considerable life events, including marital relationship or the birth of a child, might demand extra insurance coverage or modifications to existing policies.

Conclusion

Attaining savings on car insurance coverage necessitates an extensive see post understanding of coverage requirements and costs influencing aspects. Remaining notified and positive in assessing options ultimately guarantees access to cost effective car insurance policy while preserving enough protection for possessions.

At its core, auto insurance policy normally consists of several crucial elements, including obligation coverage, collision protection, and detailed protection.A number of variables significantly influence the cost of car insurance coverage costs, impacting the total price of protection. By implementing these techniques, you can efficiently decrease your automobile insurance costs while keeping ample protection.

Consistently reassessing your auto insurance plan is crucial for ensuring that you are getting the best protection for your requirements and budget plan.Attaining savings on car insurance coverage demands a comprehensive understanding of coverage demands and costs influencing elements.